Breadwinner Moms: The rise in women paying spousal support

Do women pay spousal support?

Absolutely! Women pay spousal support and it is becoming more prevalent as women continue to make advancements in career and compensation (sometimes known as Breadwinner Moms).

Most compensation studies in the United States point to gender gaps in compensation between men and but women are still working more and making more money than ever. Women now make up 47% of the workforce and employment rates for married mothers are up from 37% in 1968 to 65% in 2011. Our modern economy has created more dual income families than ever and the number of women acting as the main bread winner in their household has increased dramatically.

Breadwinner Moms

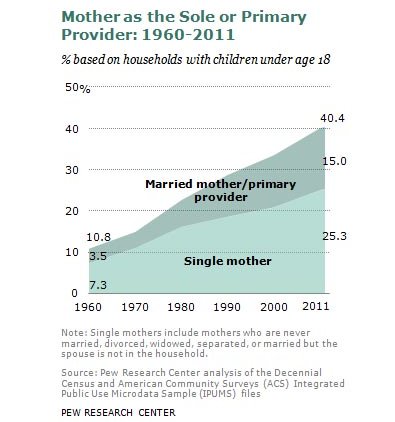

A Pew Research Center study from 2013 titled “Breadwinner Moms” found 40% of all households with children under 18 years old boast mothers as either the sole or primary breadwinner in the household. Compare this 40% to only 11% in 1960. The study was based on analysis of US Census data. It is important to recognize one major factor in these figures. 67% of those Breadwinner Moms are single mothers. Only 37% of them are married. This factor is important because the single mother cohort has a median income of only $23,000 versus the married cohort with a median income of $80,000. The married Breadwinner Moms are making more money than their husbands and more money than the national median which makes them very likely to be in a position of the spousal support payer if they were to divorce. This means there are 5.1 million women in the United States who will likely end up paying spousal support (alimony) to their former husbands in the event of divorce. Thanks to these encouraging demographic trends more women pay spousal support than ever.

A Pew Research Center study from 2013 titled “Breadwinner Moms” found 40% of all households with children under 18 years old boast mothers as either the sole or primary breadwinner in the household. Compare this 40% to only 11% in 1960. The study was based on analysis of US Census data. It is important to recognize one major factor in these figures. 67% of those Breadwinner Moms are single mothers. Only 37% of them are married. This factor is important because the single mother cohort has a median income of only $23,000 versus the married cohort with a median income of $80,000. The married Breadwinner Moms are making more money than their husbands and more money than the national median which makes them very likely to be in a position of the spousal support payer if they were to divorce. This means there are 5.1 million women in the United States who will likely end up paying spousal support (alimony) to their former husbands in the event of divorce. Thanks to these encouraging demographic trends more women pay spousal support than ever.

What about gender preference?

If the husband can demonstrate a reasonable need for spousal support and his ex-wife has the ability to pay, then he is a good candidate for spousal support. The law has no room for preferential treatment of one gender in divorces so there should be no consideration of the support recipient’s gender in setting spousal support.

Having said that we have some observations to share from our experience working with Breadwinner Moms and their spouses:

- Women are likely to fight harder than their male counterparts to avoid paying their former spouse long term alimony.

- Men are more likely to refuse spousal support because they may feel it is emasculating.

- Women often expect their former husband to “take care of himself” after divorce.

- Some Men still believe it is bad for their wives to out-earn them during marriage and this may even be a central theme as to why the marriage ended. This feeling is quickly disappearing and i am sure would quickly disappear if the men knew households with the woman as the main bread winner earned higher average income compared to those households with men as the main breadwinner.

Bottom line, there are still many traditional gender roles at play.

Wellspring Divorce Advisors offers the creative options, financial analysis and strategies necessary to ensure you obtain the most financially advantageous settlement possible. Click here to find out how we can help you!